This page contains affiliate links. Please read our disclosure for more info.

Can I buy travel insurance after departure? Yes, you can but only with a few insurance companies.

Finding travel insurance when you’re already travelling is challenging. As digital nomads, we started out with a one year long term travel insurance policy, like many round the world travellers, but unlike them, after a year we carried on travelling.

We discovered that we couldn’t extend our travel insurance and new policies required us to be living in the UK at the time of purchase. As we were overseas, we didn’t know what to do and went uninsured for months—not a good idea.

Thankfully, we discovered it is possible to buy travel insurance when already abroad—whether you forgot to buy insurance before departure or you want to travel for more than a year.

While most companies don’t allow you to buy travel insurance after departure, there are a few reliable insurers that do.

The best we’ve found (and used ourselves) are SafetyWing (available worldwide), Heymondo (worldwide and 5% off for our readers), and True Traveller (for UK and EU residents and our personal favourite).

We now always make sure we’re insured because if anything went wrong it could cost us thousands to be treated or evacuated in a medical emergency.

Contents

- Post Departure Travel Insurance Comparison Chart

- What to Look For In Your Travel Insurance Policy

- SafetyWing

- Heymondo

- True Traveller

- World Nomads

- Electronics Insurance for Travel

- Travel Insurance After Departure for Over 70s

- What’s the Best Travel Insurance While Abroad?

- Other Travel Insurance Reviews

Post Departure Travel Insurance Comparison Chart

This chart compares the companies reviewed in this post that offer the best travel insurance when already abroad.

It is difficult to do a direct price comparison for every traveller as costs depend on where you are from, where you are going, age, and level of cover needed.

The prices in this chart are for the standard/ basic packages with quotes for a 30 and 40-year-old from California, USA and from the UK. For True Traveller the quotes are for a 30 and 40-year-old from UK and France.

It’s always best to do your own quote for accurate pricing.

| SafetyWing | Heymondo | True Traveller | World Nomads | |

|---|---|---|---|---|

| Cost 4 weeks worldwide for 30 yr old (Excl. US) | $56/ £44 | $120/ £92 | £89/ €71 | $207/ £120 |

| Cost 4 weeks worldwide for 40 yr old (Incl. US) | $172/ £136 | $120/ £92 | £119/ €114 | $207/ £120 |

| Purchase After Departure? | Yes (effective immediately) | Yes (after 72 hours) | Yes (after 48 hours) | Yes (after 48-72 hours) |

| Availability | Worldwide | Worldwide except US (3) | UK & EU | Worldwide |

| Covid-19 cover | Yes | Yes | Yes (must be fully vaccinated) | Yes |

| Excess/ deductible | $0 ($250 for US) | $0 | £125/ €145 | $0 |

| Medical Cover | $250,000/£210,000 | $250,000/ £3 million | £10 million/ €10 million | $100,000/ £5-10 million |

| Baggage Cover | Up to $3000/ £2500 (1) | $1700/ £1400 | £1000/ €1200 (2) | $1000/ £1000 |

| Other features | Free cover for kids under 10/ Some coverage in home country/ Pay monthly | Dedicated app with 24/7 doctor chat | Wide range of activities included | High coverage/ many activities included |

| Best for | Budget travellers, young families, digital nomads | Over 40s, comprehensive cover | Long-term travellers from Europe | Comprehensive cover |

- SafetyWing Essential Nomad Insurance only covers lost checked luggage, not stolen baggage.

- Baggage cover is an optional extra on True Traveller’s most basic plan.

- While Heymondo is available worldwide, US residents can no longer purchase it while already abroad.

What to Look For In Your Travel Insurance Policy

- Read the small print before buying a policy or you could be wasting your money if they don’t pay out.

- When you are starting out in your home country you can buy any long term travel insurance policy for the first year. Just check they don’t require you to have a return ticket home.

- When you need to renew make sure you are allowed to buy the policy when already travelling. Sometimes the policy must be purchased 48 or 72 hours in advance. SafetyWing does not require this waiting period so is a good option if you need immediate cover.

- Medical coverage is the most important—make sure it includes emergency evacuation and repatriation.

- Check which activities the policy includes if you are going to be doing things like scuba diving, white water rafting, and horse riding. You often need to pay extra to include high-risk activities.

- Most policies charge extra for skiing and snowboarding. You might just want to purchase a winter sports policy for the time you are in the mountains.

- It’s unlikely that it will cover valuables like cameras and laptops (or the limit will be low) so you may need to get extra insurance for these (see below).

- We don’t worry about baggage cover (our clothes and toiletries are hardly valuable), but you need to decide if it’s important to you and check the per item limit.

- Cancellation cover is not available for travel insurance mid trip after you have left your home country.

- Choose a worldwide policy if you don’t know where you’ll be travelling to. Otherwise, it’ll be cheaper to exclude the US or to focus on one region like Europe.

- Check the excess/deductible (the contribution you’ll have to pay towards a claim). The higher the excess the cheaper the policy, but make sure you can afford it.

- No travel insurance covers pre-existing conditions. If you need this, SafetyWing’s Nomad Insurance Complete plan is your best option.

SafetyWing

The Best Travel Insurance When Already Abroad For Nomads Worldwide.

SafetyWing is the world’s first travel medical insurance developed specifically for nomads, by nomads. They cover people from all over the world while they are outside their home country.

We have used SafetyWing Nomad Insurance Essential in the past and loved having the ability to pay every 4 weeks and cancel at any time as we didn’t know how long we’d be away from the UK (our home country).

They offer two products:

SafetyWing Nomad Insurance Essential

SafetyWing Nomad Insurance Essential can be purchased while travelling and there’s no cap on the duration of travel.

Unlike the other insurers on this list, cover can start immediately, even if you are already abroad (as long as you haven’t already had an accident).

SafetyWing Nomad Insurance Essential includes travel medical cover such as emergency doctor and hospital visits and medical evacuation. They also cover travel delay, lost checked luggage, and personal liability. Stolen baggage isn’t covered.

It’s the most affordable long term travel insurance I’ve found for most nationalities. The standard policy costs a flat rate of US $56 per 4 weeks which is automatically charged every 4 weeks until you cancel.

This is for ages 10-39; other ages are available but will cost more (up to age 69). Travel to the US adds an extra $48.16 per 4 weeks.

There’s no deductible (except US resident who have a $250 deductible) and a $250,000 maximum limit on payouts.

Another unusual bonus is limited coverage in your home country. For every 90 days, you can use your medical coverage for 30 days in your home country (15 days in the US) if something happens while you are there.

Other benefits include free coverage for children under 10 (up to 2 per family).

The policy covers many sports and activities, but it’s best to check their website if you are interested in a particular activity. There is an optional add-on for more extreme adventure sports (like skydiving and kite surfing), but this isn’t currently available for US residents.

Unusually, they do cover moped or scooter accidents as long as you are licensed for the area where you are driving and wear a helmet. Racing and driving while intoxicated are excluded.

My SafetyWing insurance review has more details including a comparison with World Nomads and True Traveller.

Visit the SafetyWing website or use the widget below for a quote.

Nomad Insurance Complete

SafetyWing also offers a global health insurance plan for digital nomads and remote workers called Nomad Insurance Complete (previously called Nomad Health).

It offers more comprehensive health coverage than SafetyWing Nomad Insurance Essential including cancer treatment and pre-existing conditions (subject to approval).

It is significantly more expensive than Nomad Insurance Essential and you need to commit to a year contract.

A standard policy for one person aged 18-39 costs $150 a month. It costs extra to include more than 30 days in the US, Hong Kong, and Singapore.

Visit the SafetyWing website for a handy comparison between the plans.

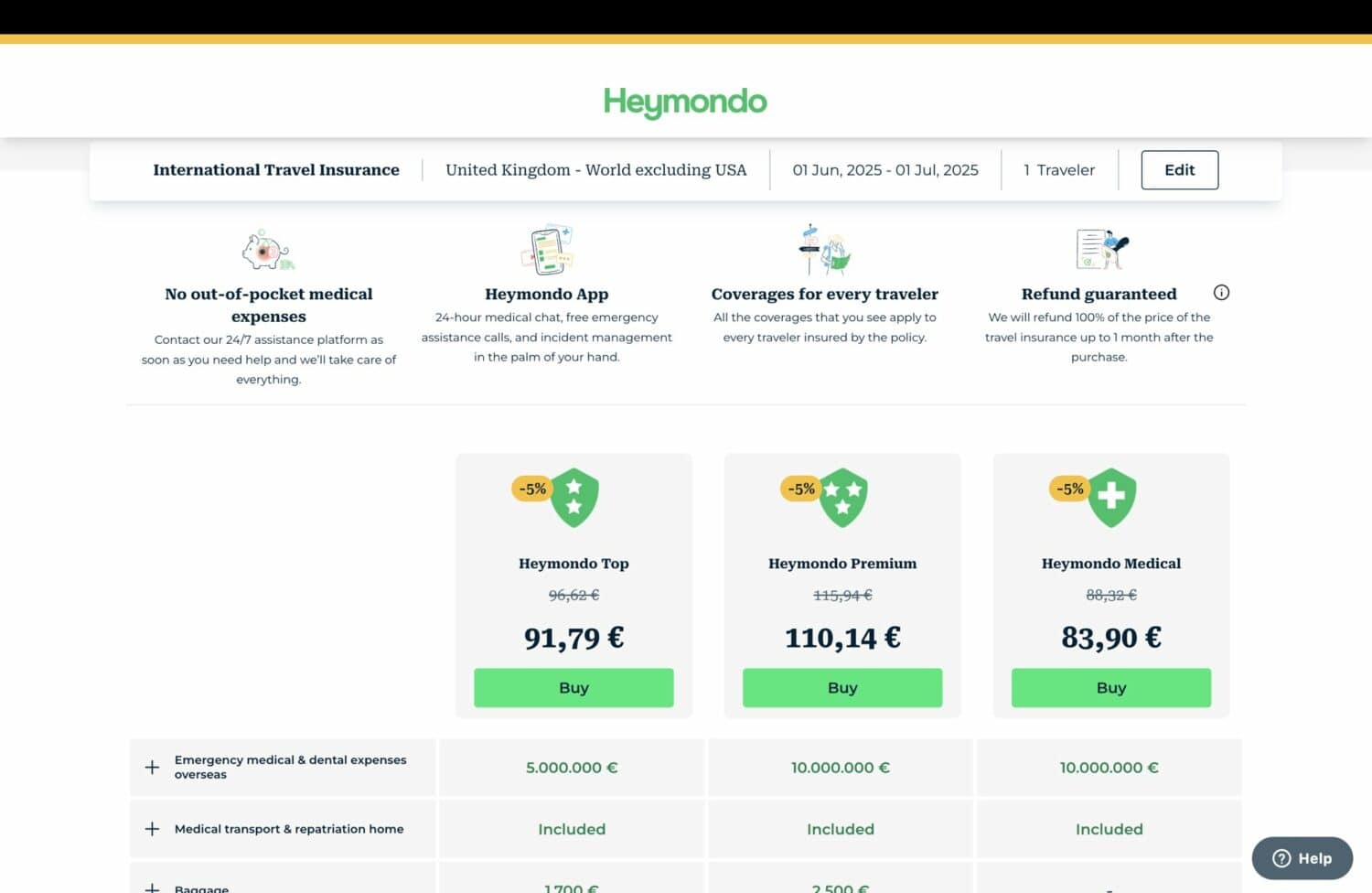

Heymondo

Comprehensive Post Departure Travel Insurance Available Worldwide (excluding the US)

Heymondo is the most recent company I’ve discovered that offers travel insurance after arrival. Their policies are very comprehensive and we’ve used them on several trips in the last few years.

Note that their policies are only valid 72 hours after purchase.

Here are some pros of Heymondo travel insurance:

- It’s available worldwide with similar coverage for most nationalities. The major exception is the USA—they no longer offer insurance when already travelling or for one way trips to Americans.

- Comprehensive coverage including high medical payouts (€3.5-10 million), although this is lower for US residents ($100,000-200,000 USD).

- You can add electronics and adventure sports coverage.

- Prices are the same for all ages and are available up to 69 years. This makes it better value for older travellers.

- There’s no deductible/excess except for the long stay policy (for trips over 90 days) and the new basic policy.

- You don’t need to pay upfront for medical expenses—contact them to take care of payment. This only works if you go to an emergency room first though (not direct to a doctor’s clinic).

- There’s a dedicated app with a doctor available for 24-hour online chat (we found this really useful a couple of times when Simon had minor health issues).

A 4-week trip worldwide (with or without the US) costs €109 for their Top policy and €139 for Premium.

This is much more expensive than other options for younger age groups, but for over 50s travelling to the US, it becomes significantly cheaper than SafetyWing.

They also have a Basic policy for some nationalities, which is cheaper if you don’t need cancellation cover or mind a small excess.

Some downsides are higher prices and limited activity coverage (including no ski cover).

If you’ll be doing lots of adventure sports, check what they cover—you might have to pay extra to include your activity. For example, horse riding isn’t in the basic plan.

The worst aspect of Heymondo is that we were not impressed with the claims process after Simon broke his foot in Japan. It is probably easier if you can get the hospital to bill them directly, but things were complicated enough managing the language barrier so we just paid and later put in a claim.

Firstly, we found it annoying that we had to call them (twice) to get them to email the claims process (an online option would be much easier). There wasn’t even a form to fill in, we just had to email them the hospital report and receipt.

While we did get a full reimbursement, it took five months (despite an estimate of 7 to 15 days). I should have chased them sooner, but even after I followed up, it took nearly two months for the money to arrive in our bank account.

We found the claims process with True Traveller much easier and faster.

Click here to get a Heymondo quote (with a 5% discount for Never Ending Voyage readers).

True Traveller

The Best Post Departure Travel Insurance for UK and EU residents.

We used True Traveller insurance for eight years as nomads and we currently use their Multi Trip insurance while we’re in the UK. It’s the best value, most digital nomad and backpacker-friendly policy we’ve found for UK and EU residents.

True Traveller allows you to buy travel insurance when already travelling and they don’t require a return ticket, so it’s ideal for digital nomads, long term travellers, or anyone who has forgotten to buy insurance before leaving.

They really understand the needs of long term travellers and you can tailor the policy to suit you, choosing the most basic medical insurance or adding extras like baggage, electronics, cancellation, activities, and winter sports cover. This helps keep costs down as you only buy what you really need.

True Traveller covers COVID-19 as long as you have been vaccinated.

If you are already abroad, cover does not start until 48 hours after purchase.

Their site is user friendly and easy to understand. True Traveller was originally an adventure travel company, not an insurance company. Their policies are designed by travellers for travellers and it shows.

Making a claim with True Traveller was quick and easy. After visiting the doctors in Bali all I had to do was fill in a simple form, take photos of the doctor’s report and receipts, and send it all by email. Just three working days later I received the money in my bank account!

You can read our detailed True Traveller insurance review here including the claims process.

How Much Does a True Traveller Policy Cost?

Currently, a one year True Value worldwide (excluding North America) policy without baggage costs £353 per person for a 39-year-old.

Although this policy excludes the US and Canada, you are covered for 14 days there without any additional cost.

To include the US for the whole year, the policy would cost £420 for a year.

It’s the best value insurance I’ve found for Brits on longer trips.

For shorter trips, it’s significantly more expensive (but more comprehensive) than SafetyWing—from £105 for 4 weeks for a 39-year-old travelling worldwide (excluding US).

We used to buy the most basic policy (only available for those under 40) to keep costs down and as we’re only interested in the medical coverage (£10 million is covered).

There’s a £125 excess (deductible) but you can pay slightly more to reduce this to zero (which I recommend).

91 activities are included as standard so we didn’t need to purchase the Adventure or Extreme pack to include high-risk activities like scuba diving at lower depths or black water rafting. Check their list to see what activities you are likely to be doing.

If you are over 40, you’ll have to purchase the Traveller or Traveller Plus policies which are more expensive but provide more coverage and a lower excess.

Unfortunately, they don’t insure those over 65.

Click here to go to True Traveller for a quote.

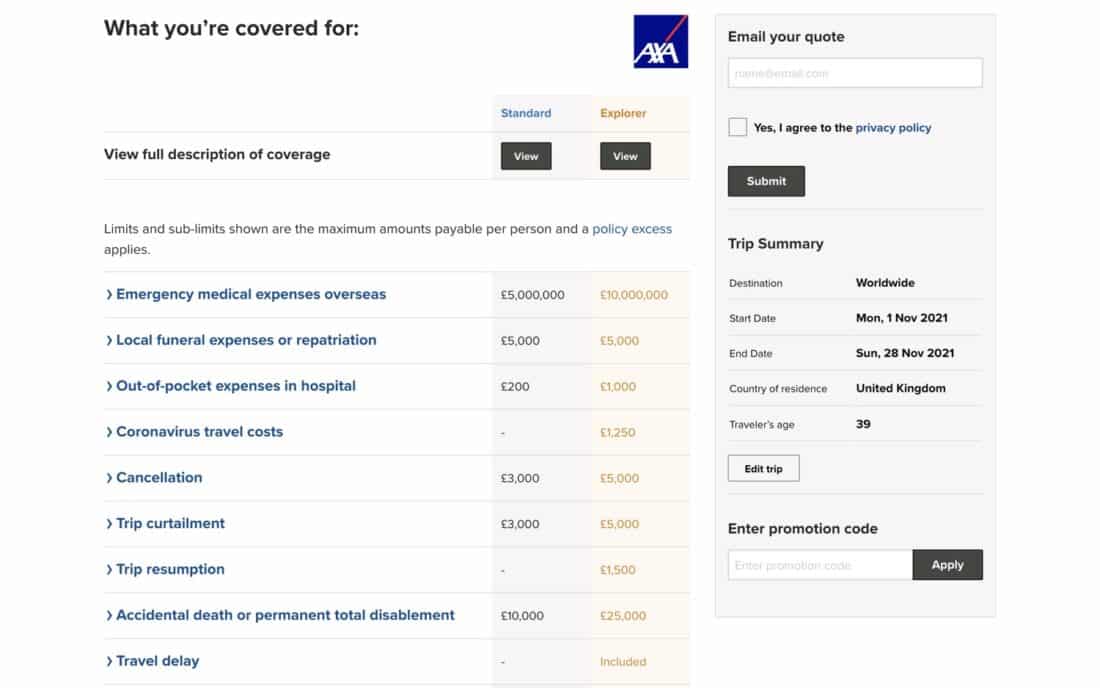

World Nomads

World Nomads is a well known travel insurance company that we used on our round the world trip in 2007-8.

They allow you to get travel insurance while abroad so are popular with many digital nomads and long term travellers we know.

For some nationalities, there is a waiting period of 48 or 72 hours before the insurance takes effect if you are away from home when you purchase. Check the terms for your country, but currently this applies to UK, Canada, and others.

Their policies are some of the most comprehensive on the market with high maximum amounts for medical cover (£5-10 million) and lots of extras like rental car excess insurance (in the Explorer plan). They also cover many adventure activities.

World Nomads is available for most nationalities.

The main downside is that they are much more expensive than both True Traveller and SafetyWing. World Nomads cover and price also varies widely depending on your country of residence.

You can see a detailed comparison in my SafetyWing review.

Electronics Insurance for Travel

Most travel insurance policies don’t cover valuables and electronics or have a low limit.

If you want to include electronics in your policy, Heymondo is the best option. With their Premium plan your electronics are covered for 50% of the baggage limit (€2500) or you can pay extra to extend this to 100%.

We used to have a separate policy with Photoguard that covered our cameras and laptops for accidental damage and theft.

They only cover UK citizens and the cost depends on the value of your items—when we last renewed ours was £263 a year.

We stopped using Photoguard as they no longer cover long term travellers, so it’s only a good option for shorter trips.

We struggled to find an electronics insurance policy that would cover us for a whole year, so we no longer have insurance for our camera and electronics. We make sure we have savings to cover their replacement if necessary.

Another option we’ve heard of is to get your electronics added to a family member’s home insurance policy.

Travel Insurance After Departure for Over 70s

We often get asked about travel insurance for over 70s as none of the insurance companies we have written about above cover those over 69 years.

Unfortunately, it’s difficult to find companies that offer travel insurance after departure and also insure older travellers.

Two companies that have been recommended by our readers are Trawick International and Seven Corners Travel Insurance.

Both have plans available for US and non-US residents. As they offer a variety of insurance options, be sure to read the small print before you purchase to find one that meets your needs (not all are available after departure).

We don’t have personal experience with either of these. Leave a comment below if you do or let us know any other options you’ve found for over 70s.

What’s the Best Travel Insurance While Abroad?

The best post departure travel insurance for you depends on your age, nationality, length of trip, and the cover you need.

If your budget is limited or you want to pay monthly, SafetyWing is best for most travellers, especially those under 50 and Americans.

True Traveller offers more comprehensive cover and can be good value for Brits and Europeans on long trips. We use them frequently and have found claims easy.

For most nationalities, Heymondo provides high levels of cover, but it can be more expensive for younger travellers and claims can be slow if you don’t bill direct.

If you are over 40, check out Heymondo as it can be more affordable than the others. They also have the best electronics cover.

Whatever you decide, make sure you do buy travel insurance. If the worst happens you’ll want to be covered or it could end up costing you more than you can afford.

I hope this post helps if you forgot to buy travel insurance or need a new policy for travel insurance while already overseas.

Let us know if you’ve heard of other companies that allow you to buy travel insurance whilst already abroad.

Other Travel Insurance Reviews

- SafetyWing Insurance Review for Nomads Worldwide

- TrueTraveller Insurance Review: The Best Long Term Insurance for UK and EU Residents

If you enjoyed this post, pin it!

Help please.

My mother went to Thailand on 9th Dec thinking that her platinum visa card included travel insurance, it doesnt and now we cannot find any travel insurance cover for her, not even medical only as she is 85 years old and will be away till mid April. We did get one outrageous quote from Cigna. We live in the UK. Any suggestions please? Many thanks in advance

That’s a difficult one – it’s so hard to get affordable travel insurance for over 70s. One reader recommended Seven Corners Travel Insurance, so you could look into them. They are based in the US but have plans for non-US residents and cover older travellers. You’d have to check if the policy would be valid when already travelling though. Good luck!

I am a South African female 71 yrs old and on holiday in the UK, and wanting to extend mt trip to take a cruise to the mediterranean, with my brother living in the UK. As my current Medical Insurance is covered on land but not for a cruise, I now need to purchase travel insurance before being able to book a trip! Can you advise me who to contact for cruise travel insurance as a South African already in the UK . Marion-Ann Finch

I’m afraid I don’t know anything about cruise insurance. I recommend contacting the 3 companies on this list that are available for South African residents (Heymondo, Safetywing and World Nomads) and asking them if cruises are covered.

Maybe this site would help? Justtravelcover(dot)com seems to offer something just for cruises. Good luck.

Great Help! THANK YOU SO VERY MUCH!

I cannot thank you enough for this article. I assumed I still had travel insurance on my credit card but went into an absolutely panic when I realised I didn’t. I broke my foot, luckily I’m in the UK so I haven’t incurred any expenses. I’m so relieved to have signed up for the insurance now. The nomad insurance was super easy to form up on. Thank you sooo much !

I’m glad it worked out for you Deepthi!

If anyone is looking for to buy travel medical while already traveling and is over 70 years old, Trawick International (as mentioned by another commenter) is an option. I haven’t made a claim with them, but their prices were reasonable for an older traveler, and I liked that you could get a medical-only plan with covid coverage. Another option is Seven Corners Travel Insurance – their Liason Plus plan is expensive, but you can purchase it while traveling and if over 70, and it covers covid (their cheaper plans do not).

Thanks for the recommendation!

Do not use Axa or hey mondo travel insurance. They do not pay their claims. They treated me like dirt. They are the worst travel insurance company on the entire planet earth. Don’t believe look at trust pilot.

Honestly, I’ve heard complaints like this about every single travel insurance company. But there are always good reviews too by people who have made claims with no problem.

Usually the issue is that the claim was not covered by the terms of the insurance for some reason. That’s why it’s so important to read the small print and make sure the policy is right for you. Unfortunately, no insurance company is going to cover every single eventuality.

Thanks for this helpful article! I also found Trawick International, and they let you sign up after already leaving. I used them in other instances where I purchased before leaving and like them. They have good COVID coverage, especially if you have to quarantine but aren’t sick, such as for asymptomatic cases or if you were exposed but test negative. They have one plan that I’ve found to be really affordable and have a lot of coverage called the Safe Travels Outbound plan. The quarantine coverage falls under the Trip Delay Max (verified by a rep.) It’s much higher than Safety Wing’s limit of $50/day for 10 days – it starts at $100/day with a $2000 max and you can purchase more coverage if you wish. You can extend your plan up to 180 days and after that, you can sign up for a new plan (according to the rep.) And it’s easy to chat with them on online chat (during US Central time zone workday.) I’ve found them to be quite responsive and helpful. I heard they have a lot of paperwork for the claims process which is unfortunate, I haven’t used that yet though so other than that I’ve liked them the most out of any company and chosen them every time.

Thank you SO much for this comment! I’m helping my parents buy travel health insurance, and none of the carriers listed in the article above will cover a 72-year-old, but Trawick will. Very helpful.

Hiya, thank you for the overview. Have you ever had to make a claim with Safety Wing? I am quite concerned after reading the reviews that it is not easy to do

We haven’t needed to make a claim. Their customer service seems really good though so I would be surprised if it was difficult to make a claim.

Me too! Did you end up using them?

Hey, great to see you guys are still on your never-ending journey after I first got inspired by your blog back in 2016. Thanks for the great tips about travel insurance here. I couldn’t find any that would cover me while already abroad. Much appreciated :)

Very useful information. Managed to get an insurance from Safety Wing after 2 weeks arrival in Singapore when numbers of COVID is increasing. Appreciate your research and article. A great relief for me.

I’m glad you were able to get insured, Peter!

This article was very helpful! Right to the point and reliable, I never ever leave comments or replies but this deserves it. My Canadian insurance expired and I am still in the United States (had to extend with the insane travel restrictions my country decided to so brilliantly implement a year after the pandemic), and this article has led me to some v helpful links!

Had my first UTI (sorry TMI), but it would have cost me upwards of 500 buckarooskis, thank god my mom made me get it before I left. TRAVEL INSURANCE IS IMPORTANT PEOPLE!

Anywho, thanks a bunch for this article!

Thank you Andrea! I’m glad you managed to get new insurance – you definitely don’t want to be without it in the US!

Nice blog. I love travelling. My hobby is travelling. But I never took travel insurance. Is it needed?

Yes it is needed. If anything goes wrong on your travels it could cost a fortune, so it’s always safer to have insurance.

Thank you so much for this article! I thought I’d spend all day trying to find a travel insurance that will provide COVID-19 cover AND accept me as someone already travelling. This made it totally hassle-free! You are absolute legends, thanks!

I’m really glad you found some insurance, Simone!

I am curious if you have a good/reliable option for flight insurance (medical not needed)? We are booked in Kauai end of summer but there are four of us flying and don’t want to pay $5000 for tickets on top of the resort cost in order to fly there just to be able to have the money refunded if we have to cancel for local coronavirus restrictions (Hanalei Bay Resort allows full refund up to seven days prior). We can purchase much more reasonable tickets for us four costing us about $2300 currently, however, wouldn’t be afforded the refund if we cancel. We would only cancel if ‘quarantine restrictions in room’ are in place at the time because we don’t want to spend half the trip in a resort room, especially since we have all had Covid, I am vaccinated (ER nurse and boy I need a vacation), and hopefully the other three in my family will be soon as well. We are hopeful at that point they will only ask for proof of vaccination instead of negative testing prior to/after arrival (which we would also do if needed), especially since Kauai has opted out of the acceptance of negative testing prior to/after arrival and currently still requires visitors to quarantine for 10 days (understandably since they only have 9 ICU beds on the island with a pop. of 55K). With all of this in mind, we want to purchase tickets BUT also want peace of mind that we can cancel and be refunded since it is such a chunk of change to fly there. To me it doesn’t make sense to pay double what the cost of tickets would be just to ensure we can be refunded, especially if there are insurance options for refund coverage. Thoughts?

That’s a tricky one. I haven’t heard of flight only insurance I’m afraid (although it could exist). I would be tempted to either wait until the last minute to book your flights or to purchase full travel insurance that covers cancellation due to covid restrictions (it’ll still be cheaper than fully refundable flights).

This might also be a situation where it’s worth talking to a travel agent (who specialises in Hawaii) as everything is changing so fast and maybe there are some new options.

Good luck and I hope you get your much-needed break!

Also, I’ve just seen that Hawaiian Airlines won’t charge change fees for tickets purchased between now and end March, so I’d recommend seeing if a flight with them works for you.

My personal items insurance with State Farm covers my 4K+ worth of electronics for $60 per year. Give them a bell. The quotes you list above for cam/electronics are a bit beastly.

Yes, if you have home insurance (which we don’t as we don’t have a home :) ) it’s worth asking them for cover.

Thank you SO much for this super helpful post! My 21 year old son is abroad for a month and I just discovered that he doesn’t have health insurance. I was searching everywhere online to figure out where I could get insurance post-departure and was getting nowhere (and panicking of course!). Then I came across your blog. Thankfully, SafetyWing has provided the insurance that he needs. I doubt I would’ve found them if it hadn’t been for your post. Thanks again…it was super helpful! I’ll be sure to keep following you for more awesome travel info!

I’m so glad you found insurance for your son, Sheila! That must be a relief.

Hello

We are also long time travelers has been for almost 6 years. We had a good travel insurance from New Zealand that covered us all those years. When we needed a letter from them for getting our Russian visa we had got an message that they will not renew us because of age. When you are 70 plus they don’t insure you anymore. We have been trying to get insurance all over the world but 70 plus is the limit. We found one in New Zealand while we were still in the Netherlands but you had to be in the country. So that we did flew back to New Zealand to get the insurance activated. We arrived just in time before they closed the borders so we are b ack in New Zealand lucky we are in our own house. Our Abel(1957 Mercedes) and Zambezi (Tent trailer) left in the Netherlands not sure when we can get back. Take care love from Fred and Elisabeth, Classicstriders. Facebook, Classicstrider.

That’s annoying that it’s hard to find insurance when you reach 70. It sounds like it’s just as well you returned to New Zealand though. We’re also here right now and it seems to be one of the safest places to be.

For those who suspect the UK insurance companies don’t tell you all up front.

Thank you for making this info available.

03 04 20 I have just found that SAGA travel and health insurance does not cover me for cancellation – they refer to pre paid trips. Abandonment seems to refer only to going back home before the holiday is due to finish.

I cannot make another insurance contract whilst I am abroad.

The 2 month insurance that I had finished yesterday it cost about £400 AUE, Thailand, Malaysia and Indonesia. Last year was about £600 for two months. I had also put China and Singapore on that one. Years ago it was Europe, middle east and far east one did not specify which countries. SAGA does NOT have an email contact. The phone number is NOT FREE from overseas. My home number is blocked and the local sim is pay as you go so it could easily run out whilst they ask me questions. Some years ago I used STAYSURE and found that their prices changed even though it was much the same trip.

I am denied access to the Middle East and British Isles, the airline has cancelled the flights and I cannot enter the place where I live.

Seems to me it’s cancellation and abandonment. A few weeks ago I could not access the BARCLAYS bank account due to a new requirement. I have been offered help to get money but I need to transfer money which I cannot do due to the bank wanting me to use a debit card and a machine to get a number so as to make a new payee. The bank messages cannot be accessed without the machine.

I’m sorry for everything you are going through, Frank. That sounds very stressful. Unfortunately most insurance companies are not covering pandemics which is leaving many travellers in difficult positions.

Thanks so much for this info! It’s priceless.

World nomads states that you must have purchased coverage prior to departure….

It might depend what country you are from as the policies for each nationality are slightly different. I know that residents of the UK, US and Australia (amongst others) can definitely purchase a policy when they are already travelling.

Excellent information. Super useful and reliable! Thanks for sharing your experience with everyone!

I wonder if anyone has some good recommendations (or any ideas!) for long-term travel insurance, or for renewing travel insurance while out on the road, for a traveller who happens to be over 65 years old?

I’m 67 and I get an amusing (not) run-around on websites….. “for a long trip you need Backpacker Insurance”….. “for Backpacker Insurance you need to be 65 years or under”….. “You need our Seniors Policy”….. “Our Seniors Policy is only available for a maximum trip duration of 90 days”….. and so on.

That is frustrating! Have you tried World Nomads? I just did a test quote and it seems to work. They insure people up to 70 although the maximum trip length seems to be 180 days. But you can always get another policy after that as World Nomads allows you to buy a policy when you are already abroad. Good luck with it!

Hello I’m a Canadian Citizen currently visiting Africa for the next 2 months. Do you provide Post Departure Travel Insurance.

Please send me a link. Thx

We don’t provide insurance but we recommend World Nomads who provide post departure travel insurance.

Great info, thanks. I am a US citizen and I took a couple of months off to visit my parents in their new retirement home in Mexico. I just learned that I have been accepted at graduate school in Europe and I won’t have the time to return to the USA (and purchase insurance) before I depart for Europe. I have a one-way ticket and will need travel insurance for only the first few weeks in Europe, until my university student instance kicks in. Your article mentioning World Nomads and IMG are so helpful. Much appreciated.

I’m glad it helped and enjoy graduate school!

Guys,

Thank you very much for sharing your experience. It was very useful for us. Best, JM

I’m glad you found it useful Juan.

hi guys, i used your link to buy my insurance as traveller via True traveller . thank you so much you literally saved my life and also gave me so much good tips for ubud thanks a lot

Thanks Dee! I’m glad you found the Ubud posts helpful!

Remember that Insurance companies hate to pay out so it is good to read fully all the ts & cs for any company you choose.

Thanks, I’ve been on the road 2 years now, and my insurance just expired again – it’s getting more difficult each time!

Also, with World Nomads you can just type in a continent, like “Africa”, so you don’t have to type in specific countries.

We’re just in the process of having to renew with World Nomads and things have changed so it’s looking like a new nightmare. It looks like you now have to state all the countries you’ll be travelling in…. what long term travellers knows that in advance! And we can’t use true traveller as we’re Australian.

Definitely the not-so-fun part of travelling!

That’s really strange. Perhaps you should contact them and get clarification on that as it really doesn’t seem practical for their target market. Good luck with it!

World Nomads just asks you these questions up front in order to assess whether or not they can give you a cheaper policy if you won’t be visiting certain countries. In particular, avoiding the U.S. often saves you a lot on travel insurance, depending on where you are from. If you plan to go all over the place, just throw in a handful of countries and you should see yourself fall into a worldwide policy on the next page, which states you are covered everywhere, regardless of the countries you actually typed in.

Thanks for such an informative post. I think we’ll be checking out True Traveler. Really appreciate the insight into your own experience!

In looking into World Nomads (as we are US-based and thus not eligible for TrueTraveller), I got two substantially different quotes for the same place (Bogota, Colombia).

By going directly to the World Nomads site via your link, the price was $206 for three months (the minimum length of time one was allowed to insure for), but when I went to this Lonely Planet web page, I could specify the length more precisely and put in two months. The cost was $169. You can specify even shorter lengths of time if you like, and I assume the price goes down accordingly.

http://www.journeyman-services.com/ is pretty good if you have a main base and are only doing trips of 90 days or less. I used it when I was teaching abroad, but it won’t cover you for the country you’re using as the base.

I wont travel without ravel insurance. The peace of mind it brings is totally worth it for me.

Thanks for posting this. My year long travel insurance just ran out and as I don’t plan on returning home anytime soon I was confused about how to make sure I’m covered. Thanks for the tips :)

Thanks for the tip about True Traveller. We’re working in China at the moment so we’re not ‘travelling’ as such but this will come in handy for after.

Great Post! For over three years I used the “Liaison Majestic” policy from Seven Corners (www.sevencorners.com), made well over a dozen claims, and they refunded every single one of them. This plan can be renewed for up to three years, and after that you can buy a new plan, effectively extending it indefinitely. You can also buy their plans if you are already traveling. Highly recommended!

Thanks for the tip Adam!

Good post. I had travel insurance, but I let it lag and the stupid company would not let me buy it from over seas, only renew it.

I haven’t gone for travel insurance yet, but it’s great to read these options. I really should buck up and pay for it!

It’s so tempting not to bother but if the worst happens you’ll probably regret it.

Oh no! I just renewed two days ago and I wish I’d read this first. I didn’t really want to continue with the same company we were already with but I was struggling to find a company that we were already insured with.

I’m going to bookmark this for next year when we need a new policy again :-) Thanks for another helpful post!

That’s bad timing! Most insurance policies let you cancel within the first few weeks I think (although possibly not if you are already on the road) so that may be an option. If not, next year!