This page contains affiliate links. Please read our disclosure for more info.

One of the complicated things about being a digital nomad who earns in multiple currencies is how to get paid. Both PayPal and our UK bank account charge high fees to receive money in a foreign currency and convert it into British pounds.

The situation for getting paid by the Amazon US affiliate program was even worse as they would only pay us by cheque in dollars, which was a slow and annoying process.

Thankfully the Wise Multi-Currency Account (previously known as Transferwise Borderless) came along and solved all our foreign payment problems.

In this Wise Multi-Currency Account review I share why it’s ideal for digital nomads, costs, and other useful tips for using the account.

Contents

- What is a Wise Multi-Currency Account?

- Who Can Get a Wise Multi-Currency Account?

- What Does it Cost?

- Wise Multi-Currency Debit Mastercard

- How Do You Set Up A Wise Multi-Currency Account?

- Is Wise Safe?

- Summary

What is a Wise Multi-Currency Account?

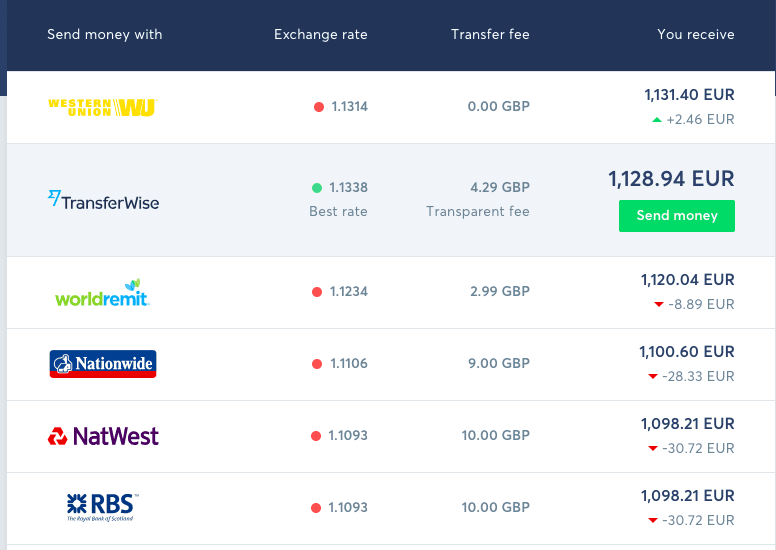

Wise is a company that has been around for years offering low-cost overseas bank transfers. Their fees are way lower than the banks, they always use the mid-market exchange rate, and the process is quick and simple.

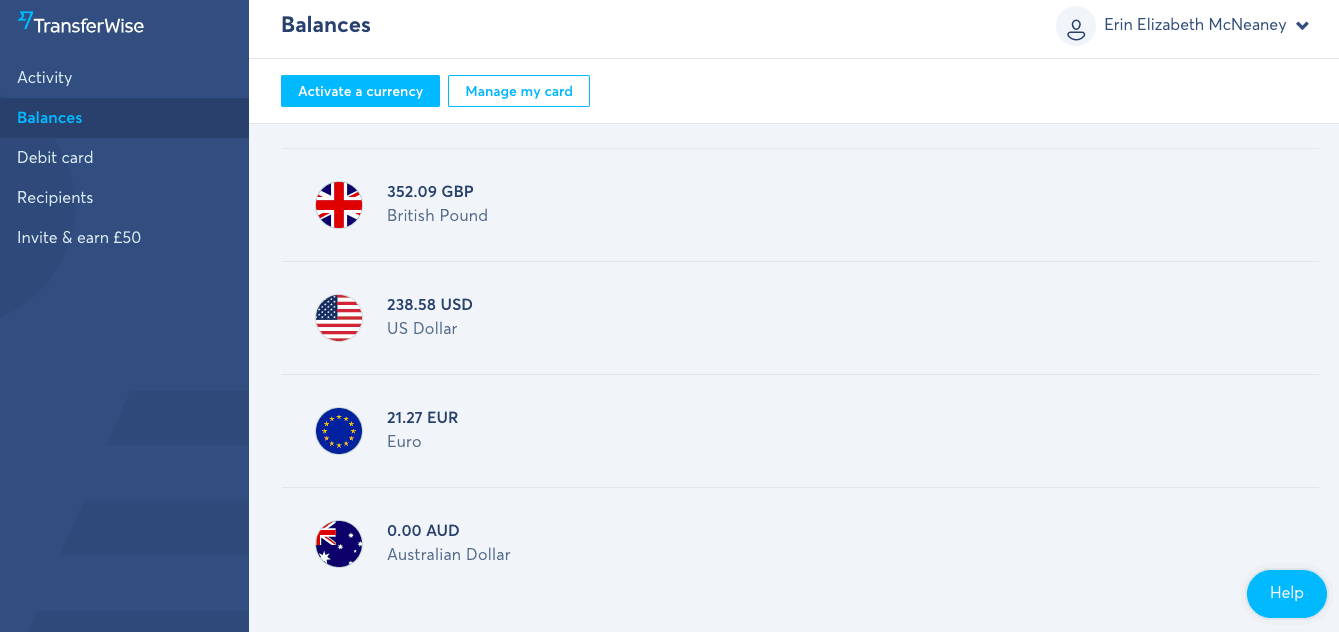

The Wise Multi-Currency Account was launched in 2017 to allow people to hold bank accounts in multiple currencies. With our account we are given bank details for British, US, European, Australian, and New Zealand bank accounts which means we can receive money into them in the local currency (dollars or euros etc.) with no charge.

This saves us a fortune on bank fees and means we no longer have to deal with annoying Amazon cheques as we can get paid straight into our US bank account. We have now switched most of our income from foreign sources to Wise and get paid in a mix of US dollars, Euros, and Australian dollars.

You can have bank details in the UK, US, Europe, Australia, New Zealand, Singapore, Hungary and Turkey (more countries coming soon) and also hold and convert 40+ other currencies and send money to 50+ countries.

Who Can Get a Wise Multi-Currency Account?

Most nationalities can open a Wise Multi-Currency Account.

What Does it Cost?

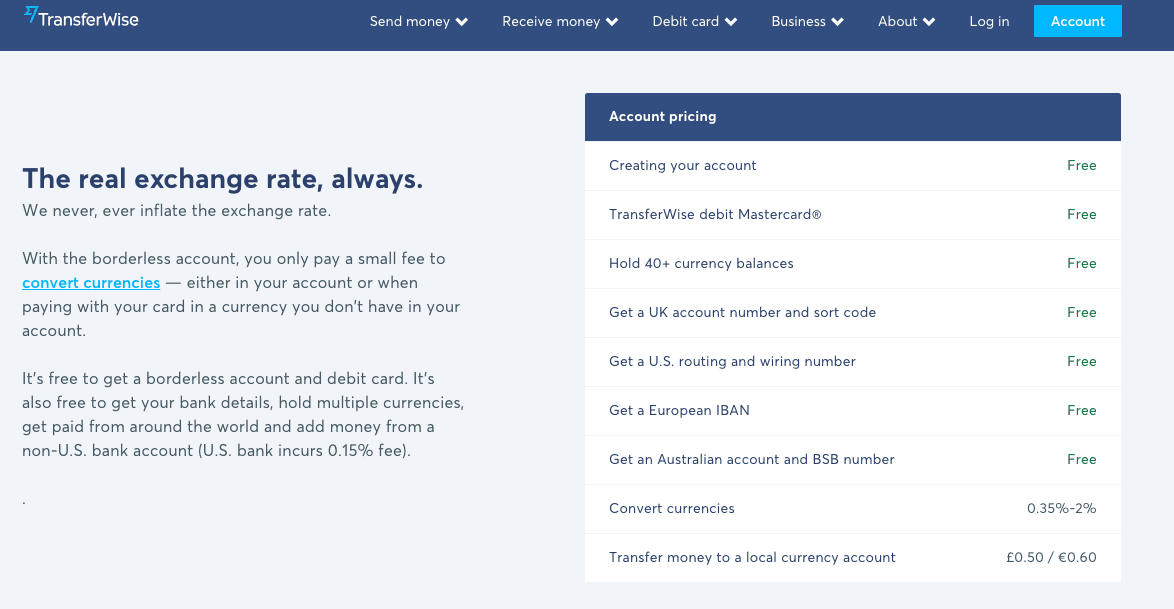

It costs nothing to set up an account or receive money into our bank accounts from the same currency. But then how do we get it out? We have a few options:

1) Use the Wise Debit Card to make an online transaction in the same currency (i.e. pay our hosting bill in dollars from our US account) for free.

2) Withdraw cash with the Wise Debit Card in the same currency (i.e. euros when we’re in Europe). This is free for up to £200 ($250) a month then 1.75% after that.

3) Send the money to a bank account in the same currency. For example, we pay our Pinterest manager by bank transfer in dollars from our US account. The cost for sending money depends on the currency. For USD there’s a $1 fee and for Euros it’s €0.80.

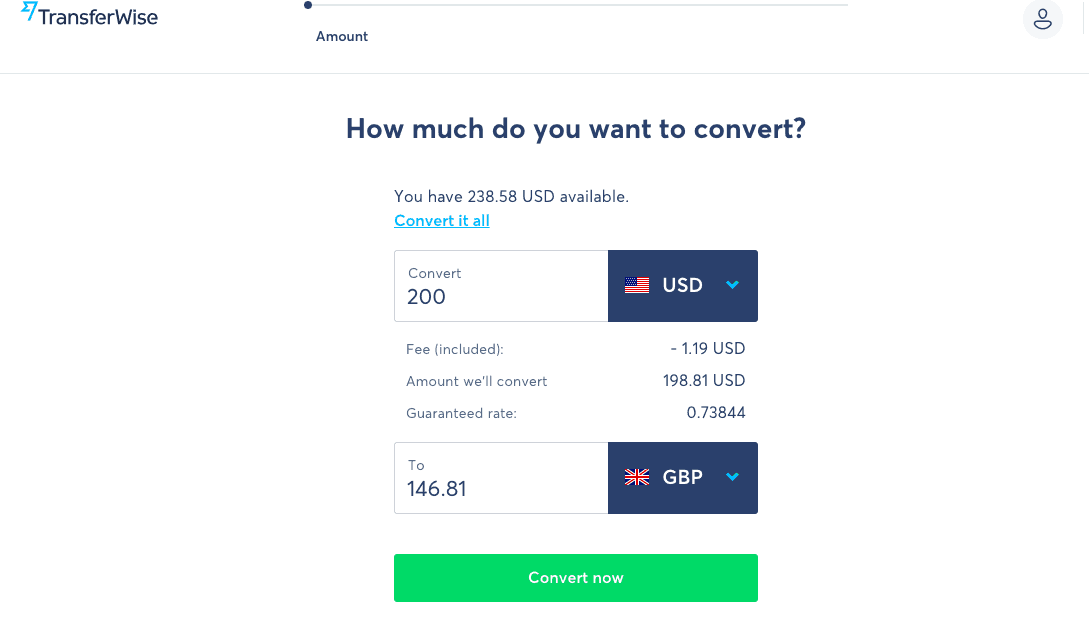

4) Convert money from one currency to your home currency and transfer it to your home bank account. If we don’t have anything we need to use our foreign balances for, we convert it to pounds and withdraw it to our UK bank account.

Wise always uses the current mid-market rate for foreign exchanges (unlike our bank and PayPal) and then charges a small fee depending on the currency. For example to transfer USD to GBP costs 0.6% and EUR to GBP cost 0.3%.

Once the pounds are in the GBP section of our Wise account, we can spend it in pounds on our debit card or withdraw to our UK bank account for a £0.65 fee.

If this sounds complicated, it’s really not. Wise is very simple to use. It takes seconds to transfer money between currencies and withdraw to bank accounts (once you’ve added the bank details). They are always transparent about the fees and will tell you the charge before you make the transfer.

You can see more about Wise Multi-Currency Account pricing here.

Wise Multi-Currency Debit Mastercard

The Wise Multi-Currency Debit Mastercard was released in 2018 and we love it! Wise’s international transfer fees are way lower than banks, but the card allows us to avoid even these low fees by spending money in the same currency we received it.

You have to request a Wise debit card and this costs £5.

We’ve used the card in France, Italy, Australia and the US to spend money from our Euros, AUD or USD account either by withdrawing cash or as a card transaction in a restaurant or shop. We’ve had no problems with it and love that the Wise app sends you a notification about what you just spent (great for security).

We’ve avoided fees by only withdrawing up to £200 in cash a month. After this Wise charges 1.75%. Although this is a lot lower than most bank accounts (Lloyds charge 2.99% plus £1.99 per withdrawal), we can get fee-free cash withdrawals with our Starling mobile bank account, so we’d rather do that.

We have also switched all of our monthly USD direct debits to come out of our USD account using the Wise debit card to further reduce exchange fees.

You can use the debit card to spend money in any currency, even if you don’t have a balance in it. Wise will take it out of your balance that has the lowest exchange fee, which can range from 0.35–2%.

How Do You Set Up A Wise Multi-Currency Account?

Setting up a Wise Multi-Currency Account is quick and simple. You enter your details (including a phone number to get a security code sent to) and upload a photo of your ID (passport or driving license). It said it could take up to five working days to verify my identity but it worked instantly for me.

I then logged into my account and activated my USD, EUR, GBP, and AUD accounts with one click and could see the local bank details for each of them. Other local accounts are now available.

You can see the balances of each of these accounts in one page. If you click on USD it will show you your balance and bank details and you can click on the buttons to “Send USD”, “Add USD” or “Convert USD”. These processes take just seconds.

You can request a debit card from the Debit card page of your Wise account.

To log in to your account securely you can either add a phone number and they will send you a security code by message or voice call when you log in or set up 2-step log-in on the Wise app. I recommend the app as it’s easier and you don’t have to worry if you change your phone number.

When we first used Wise we did end up changing our phone number (as we moved countries and changed SIMs) and couldn’t log in. I had to call Wise but they were very helpful and sorted it out quickly.

Is Wise Safe?

Wise is regulated by the FCA. It uses trusted low-risk local banks to store your money—for example in the UK it uses Barclays. If Wise became insolvent your money would be unaffected and will be refunded within 10 working days.

However, Wise isn’t as secure as a normal bank because your money is not guaranteed by the Financial Services Compensation Scheme (FSCS). If the bank where Wise stores your money (i.e. Barclays in the UK) were to become insolvent then you aren’t guaranteed the return of your funds (usually you’d get up to £85,000 back).

Because of this I don’t recommend storing huge amounts of money for a long time in your Wise account. I feel confident keeping small amounts in it for a month or two, as it’s extremely unlikely that the banks they use would become insolvent. It won’t replace your existing bank account but can be used alongside it.

Summary

The Wise Multi-Currency Account has solved a major problem for digital nomads and freelancers like us who earn money in different currencies. It has saved us a huge amount in exchange fees and means we no longer have to deal with antiquated cheques.

If you get paid in multiple currencies I definitely recommend giving it a try—you can sign up here.

Wise is also useful for anyone who transfers money from one currency to another—their fees are lower and more transparent than banks and it’s easy to use. You don’t need to sign up for a Wise Multi-Currency Account to make a transfer.

If you enjoyed this post, pin it for later!

This post was originally written in May 2018 and last updated in April 2021 after Transferwise Borderless became the Wise Multi-Currency Account.

Thank you, Erin, for a great review. I should’ve opened Transferwise account way earlier, but, to be honest, just been lazy. The final straw came this month when another bank transfer went the way of the dodos. Twice in two months – you must be kidding me! That, indeed, put me outside of the comfort zone. Anyway, I didn’t really need a lot of, to begin with, but your post was the final touch. Cheers!

I hope it works out for you!

Thanks so much for sharing this.I’m a 3D artist/freelancer in Kenya and I have been struggling with Skrill and Paypal who are not very efficient.I’ll certainly, get the borderless account as I usually get paid in different currencies and lose huge amounts in the exchanges between companies. Will certainly use your link as you have assisted me a lot.thanks again

Paypal is the worst! I hope Transferwise works out for you!

Hi, does this work with International Amazon Affiliates? Thanks!

Yes it does. We are Amazon affiliates from the UK and get paid by Amazon US into our Transferwise US account.

My experience so far has been quite bad with Transferwise. I signed up for want of convenience and even put away signing up with a local bank in Munich but the debit card has taken forever to arrive. So much that I don’t trust it’s arriving anytime soon. The response from Transferwise’s customer care has been very dismal- I don’t see an iota of ownership or responsibility in their responses

I’m really sorry to hear that Aishwarya. My experience with their customer service team has been excellent so this does surprise me. I hope your card arrives soon.

Can anyone tell me how to access our money in the UK? We are US citizens, and don’t have the bank card option available and do not have a UK bank.

I think you’d have to use your US bank card to withdraw money. I don’t think there’s a way to access your Transferwise account without their card but you could try contacting Transferwise.

Unfortunately it’s no longer possible to add a US bank account to a UK Paypal account. I tried this week and was told that they have removed Transferwise from their list of acceptable US accounts. Maybe too many people we trying to avoid hefty Paypal fees. It’s a shame!

Oh no, that’s a shame. Our US Transferwise account still works on Paypal. It might be worth trying again (by phone) and giving the US bank name (Community Federal Savings Bank) rather than Transferwise.

I tried again today and they said they’ve blocked accounts from Community Federal Savings Bank from being added. I hate Paypal!

Oh no, that’s rubbish! They must have realised that people are using Transferwise to avoid their fees.

Hi There, Do we know if other currencies beyond GBP/USD/EUR/UAD are going to be added to the Borderless account – for example CHF ?

I think they plan to but I don’t know what or when. I recommend contacting Transferwise to ask them – the more requests they get the more likely they are to add it.

Why the hell Brazil is not on the list of countries that can have a TBA. Always, of course, our damn country is left out due bureaucracy, language barrier an all the other issues…tired of living here!

I’m so sorry to hear that. I would contact Transferwise (they are very responsive) and request it.

Hi there…I had already opened a borderless account with Transferwise only this month ..before I read your story, so it is good news to hear it works so well for you. One quick question was your reference to using it to pay monthly direct debits??? If I understand that correctly does that mean you can use the account o also pay monthly payments such as insurances for example??

For our monthly payments we don’t use direct debit – we give our card details to the company and they charge it each month like a credit card. It doesn’t look like Transferwise can be used for direct debits yet but they are working on it.

I am a South African working remotely for an American company and dating a European (complicated I know :D). I get paid in USD via PayPal who I loathe. Unfortunately I can’t figure out a way to transfer the USD to Transferwise so I can send the money to my girlfriend in Netherlands/Germany at a reasonable rate.

If I had a US bank account I’m sure this would work but I’ve heard it’s impossible to setup as a foreigner. For now it seems I have to use this useless rent-seeking PayPal service until I can find a solution.

Have you set up a Transferwise Borderless account? It seems that South Africans can and then you can get US bank details. If you are able to link that account to your Paypal account (I did it by phone as described on this post), then you can avoid any Paypal fees. Good luck!

Yes I have a borderless account but unfortunately they only provide bank details for EU, UK and AUS so it seems I’m outta luck?

Hmm, that’s strange. Maybe contact them and ask if they are planning to offer US bank details for South Africans.

Hi Erin,

I’m curious if you have set up a self-employment or limited company and if you are using the regular Borderless account to receive payments (as the business Borderless does not provide Debit card at the moment). I’m about to set up a business (limited company) either in Ireland or Estonia (for working as developer and later on for other entrepreneurship projects) but for both scenarios I’m supposed to open a bank account at local bank (Borderless Buiness can also work as I was told).

We are self employed (with a partnership of the two of us) and not a limited company so we don’t bother using business bank accounts. We just have the individual Borderless account.

Thanks loads. I use Transferwise to transfer money from my UK bank to my Spanish bank and it is cheap, efficiently quick and any problems, the contact centre is brilliant with the right advice.

Ill certainly open this bank account and hope they extend out to Asian countries soon.

I’m glad it’s working out for you!

Thank you so much for all the awesome advice. I’m totally new to the concept of Fintech, but I think it’s awesome (since I’m now living in country number 4!). I’ve done lots of reviewing over the last few days to see which company I should go with, so thanks for your review. I’ve also just downloaded the Trail Wallet app in preparation for a big Eastern Europe trip I’m doing in 6 months time – what a great idea! Thanks :)

I’m glad it helped Claudia! And I hope Trail Wallet helps you stay on budget. Enjoy your trip!

First time I’ve heard of this and it’s amazing! More people should know about Transferwise. Thanks for the last bit about our accounts not being guaranteed though. Keeping small amounts is a good workaround.

I know, I really want to spread the word as it’s so useful! It is saving us so much money in exchange fees (and the hassle of dealing with annoying cheques).